How Early Risk Detection Revolutionizes Modern Business Strategies

In the dynamic and unpredictable landscape of today's world, it's crucial for organizations to recognize the importance of enterprise risk management.

Businesses constantly encounter many risks that can significantly impact their operations, reputation, and financial stability.

Why do companies need risk-sensing platforms?

The need for early sensing risk platforms or strategic intelligence platforms arises from the ever-increasing complexity and unpredictability of the business environment. Traditional risk management approaches often rely on historical data and reactive measures, which may not give enough information to address emerging risks or trends.

By leveraging advanced technologies such as AI and analytical tools, early warning systems enable companies to recognize potential risks before they quickly escalate into major issues. Using risk sensing programs described in the Deloitte report should help senior executives reach their goals by managing reputation risk.

Integrating Early Warning Systems into ERM processes

Early warning systems complement and strengthen the overall enterprise risk management (ERM) process. By providing timely and accurate risk intelligence, these platforms enable organizations to identify and assess risks more comprehensively.

This information can then be integrated into the ERM framework to inform strategic decision-making and resource allocation.

The benefits of Early Warning Systems

Early warning systems offer several key benefits for organizations:

1. Timely risk identification and mitigation

Risk-sensing platforms enable companies to identify potential risks at their nascent stages, allowing for timely intervention and mitigation strategies. By staying ahead of emerging risks, businesses can minimize their impact on operations, reputation, and financial stability.

2. Proactive decision-making

With access to real-time risk information provided by risk-sensing systems, decision-makers can make informed choices to prevent or reduce potential losses. This proactive approach empowers organizations to adapt quickly to changing market conditions and make strategic decisions based on accurate insights.

3. Enhanced resilience and business continuity

By identifying vulnerabilities in advance, early warning systems help organizations enhance their resilience against disruptions. With timely knowledge of potential risks, companies can implement effective contingency plans to ensure business continuity even in challenging circumstances.

4. Cost savings and efficiency

Addressing risks at an early stage is generally more cost-effective than dealing with full-blown crises later on. By taking preventive actions based on insights from early warning systems, companies can save themselves from costly damages or legal consequences down the line.

Unlocking the ROI potential

While quantifying early warning systems' return on investment (ROI) can be challenging, the potential benefits are significant. These systems improve decision-making and strategic planning, enhancing business performance and a competitive edge, adding value to the ERM Process.

Early warning systems play a crucial role in enhancing the effectiveness of enterprise risk management (ERM) processes. By providing timely and accurate risk intelligence, these platforms enable organizations to identify and assess risks more comprehensively.

This information can then be integrated into the overall risk management framework to inform strategic decision-making and resource allocation.

Embracing automation for efficiency

Utilizing an early warning platform offers several advantages over manual risk monitoring:

- Automation: Early warning platforms automate data collection, analysis, and reporting processes, saving time and resources compared to manual methods.

- Scalability: As businesses grow and face increasing complexities, early warning platforms can scale up to handle larger volumes of data and deliver actionable insights.

- Integration: Early warning platforms can integrate with existing risk management systems, enabling seamless information flow across different departments or business units.

- Real-time Monitoring: These platforms provide real-time monitoring capabilities that allow for immediate response to emerging risks or threats.

In conclusion, early warning or risk-sensing systems are essential for modern businesses operating in a fast-changing and uncertain world. By proactively identifying and addressing potential risks, organizations can enhance their resilience, improve decision-making processes, and ultimately safeguard their long-term success.

We asked Mathias Coene, PwC | Director - RAS RCC - Risk, Controls & Compliance, about his thoughts on the topic

In a business environment subject to constant disruption, superior risk management has become a competitive advantage in all industries. Risk Management is the disciplined and structured process of dealing with uncertainty and its effect on making risk-informed decisions. In doing so, organizations identify and manage a broad portfolio of significant events that might have an impact on the organization's success.

In recent PwC thought leadership, it's evident that top-performing organizations gain a competitive edge by proactively reshaping their approach to managing risks. They not only excel in the present but also prepare for the future by reimagining how they perceive and navigate the complex risk landscape. The message is clear: others need to do the same and embrace this forward-thinking mindset.

Too often, risk management relies primarily on wisdom, judgment, past experience, and long-held techniques to assess potential risk and their consequences. Far less often is the organization and risk function using significant data to look forward, identify patterns, detect warning signals of new threats across the risk spectrum, and analyze the potential for and impact of risks.

We are seeing more and more leaders positioning themselves to anticipate risks and see changes in real time, using internal and external data and new risk technologies to monitor and anticipate risks and analyze them more carefully.

Businesses now actively utilize real-time data in various aspects of their operations. Leveraging on this continued push toward using more advanced techniques, we see that risk functions are increasingly transforming and developing continuous risk-sensing capabilities.

Leading risk management functions are building early warning systems and reporting on key risk indicators. Resulting in a shift towards a more proactive risk focus through a data-enabled approach. Data is a key tool in the arsenal to detect changes in the risk landscape and create actionable risk intelligence for decision-making.

It's the trick of leveraging data to look ahead and use foresight to anticipate. In practice it's a matter of looking ahead systematically. To identify early trends and indicators and to link and translate these future developments into implications and insights to organizations' current repertoire. Easy said, but not that easily done.

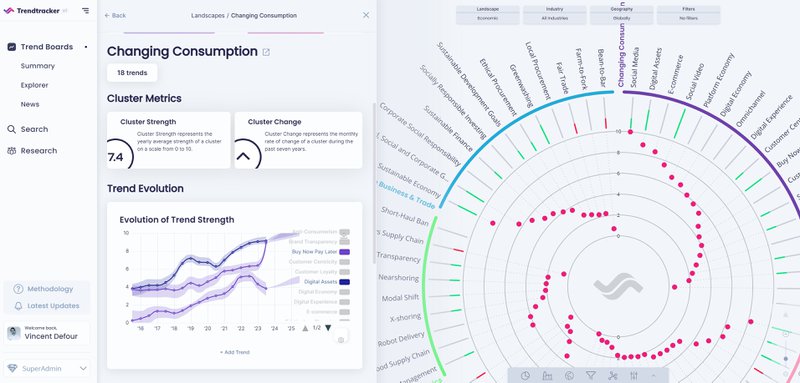

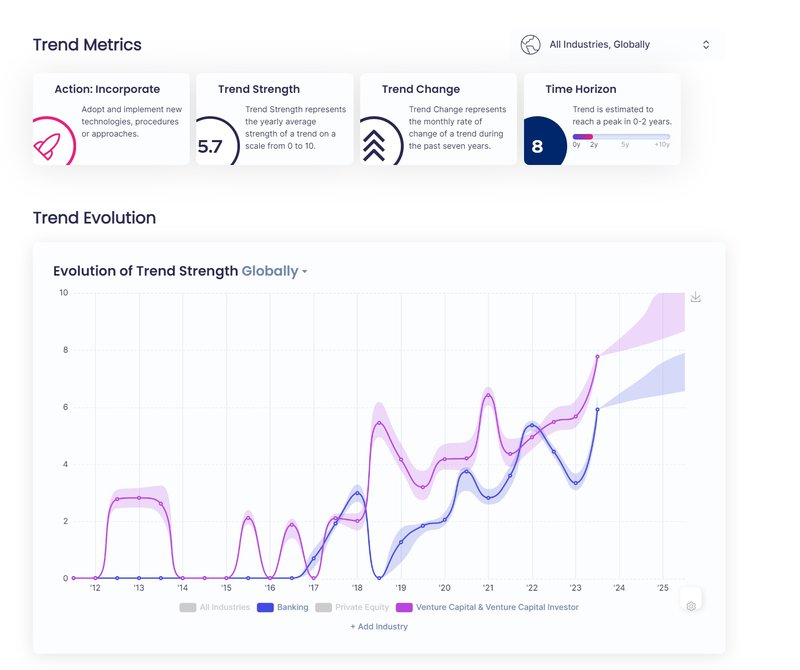

The power of a platform such as Trendtracker can provide organizations with exactly the risk foresight information they need. It provides an overview of ongoing trends and evolutions, can give some context to put it into perspective, and, based on metrics defined in the back-end, can help assess the significance and expected evolution. - Mathias Coene, PwC | Director - RAS RCC - Risk, Controls & Compliance

The above information is based on his personal opinion and experience as a director at PwC, focusing on risk management services. It is not intended as an official statement from PwC.